As an economist it encourages emigration at a time when we seem he'll bent on stopping immigration.

As a psychologist I can't help thinking we are seriously fucking around with the heads of our young people (as if they'll want to fund our care in later life). Why should they pay this graduate tax or be forced out of of the country of their birth. How can they buy a house, these new indentured generations.

As a historian... As you all know, in the 1980's when Deadbeat began tuition fees did not exist.

Countless numbers of politicians went to university for free and many got government grants not loans to go.

A covenant scheme existed for parents to elect to pay financial support for their children.

The credit checking inustry did not exist.

Did we really want to find ourselves in 2023 with our children unable to buy a property because they pay such a high amount of money back they cant afford the property prices.

Property will CRASH in 2024, I'm convinced but there are numerous things keeping it up at the moment. Agents are pushing higher rents claiming housing shortages.

These shortages are due to many graduates from 2000-2010 being unable to afford the prices, so they pay increasingly higher rent. As interest rates go up they have no chance of even considering the purchase of a house as nobody would lend them the money.

Markets do have a habit of moving towards equilibrium. Anyone who understands geology recognises metamorphosis and economists do too.

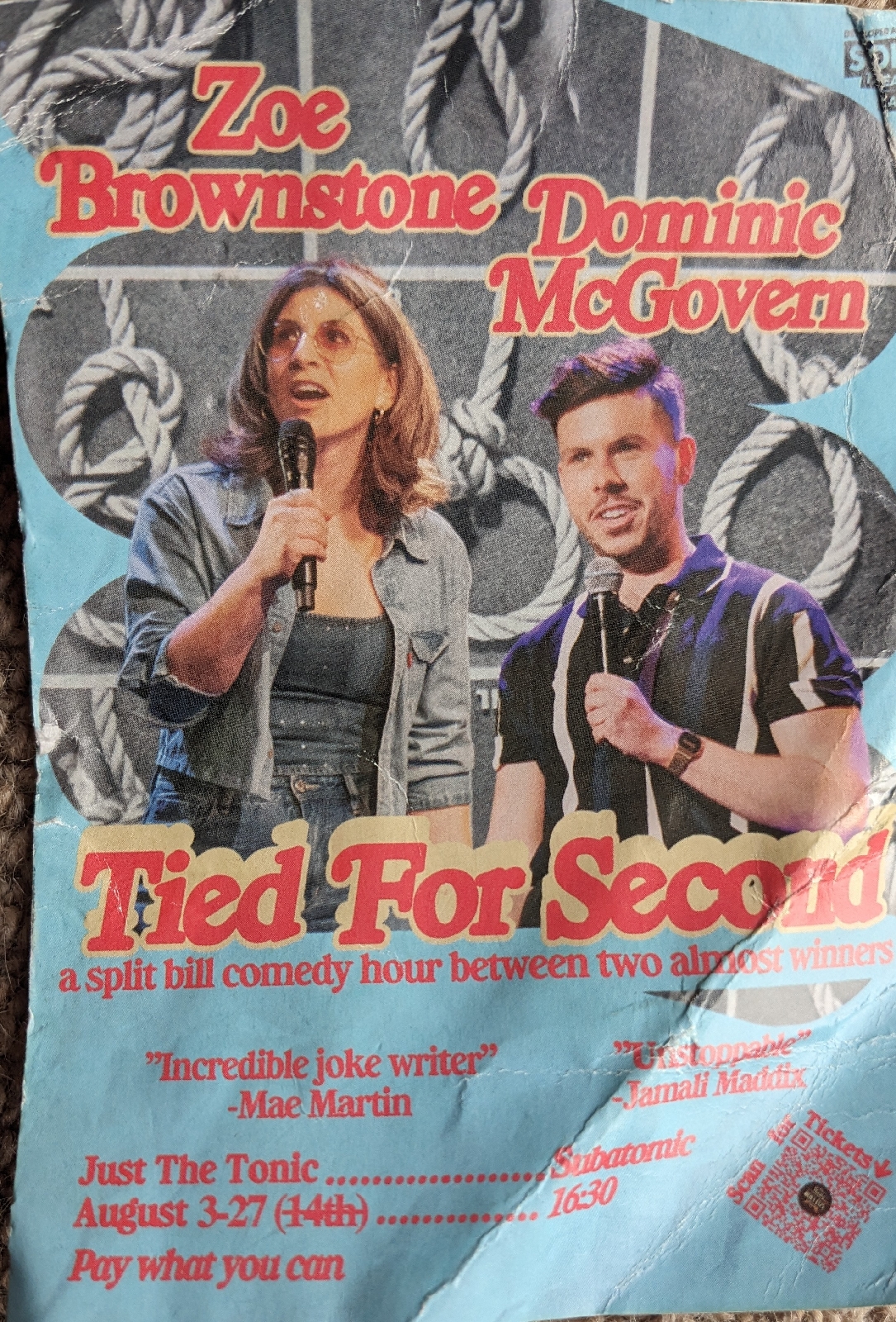

I want to have a comedic rant about this because the Fringe is on in Edinburgh. There is so much material.

I grew increasingly alarmed in the 90's when homelessness was rising and the buy to let concept became mainstream. People have always bought second homes or houses for their kids or renting but it suddenly became an industry. This is not a good look for society when but to let mortgages were easier to get than first homes.

These are the tectonic plates of a society. One person is describing a property while another is describing a home. Tectonic plates have a habit of creating eruptions.

The Bank of England are trying to control inflation, but its the supply side it affects these days. They have no other tool to use so the only debate they have is up or down. They should get brave and flatten it.

Ireland has a national debt of 220 bn EURO, the people in England who went to Uni have that on their personal balance sheet.

Did Thatcher and Blair really know they were using the young people of this country to underwrite the UK Economy. My stats are just England as per the info on the westminster website.

I wrote a review of Bob's great book on Carrillion and the corrupt UK State but this mind numbing discovery does my head in.

If the UK Debt was £1 trillion the true figure would be £1.2 Tn if we included or even funded students like Blair and Thatcher received. We moved education off the balance sheet.

I'll say it again, we moved education off the balance sheet and passed it to the voters who had gone to University.

Our collection rate is 27%. That means 73% default over 20-30 years.

That means the 27% who dont default will have to pay more tax later on to fund the defaulters.

We have just shut down immigration but if you emigrate you needn't pay back your loan.

I'm thinking this policy was ill concieved and yet Student loans continue.

In Scotland we dont pay tuition fees but Nick Clegg in England decided a ministerial car and pension was worth more than a principle.

I'm thinking, see you next tuesday, and I'm not even a liberal.

I think somebody explained how they'd 'moved the debt off the country's balance sheet into the hands of the individuals who received the education' was an argument that won the day. Truth is, if someone said that to me, I'd say immediately, encourage them to become a joiner or a plumber a nurse or a dental assistant. I'd suggest that on the job training that didnt involve going to University and incurring a life and mind changing debt would be wiser.

Why would any responsible government ever encourage someone with no money or job to assume a £100,000 of debt in the hope they might get a better job than they would do if they just left school and started working.

Growing up I was lucky. I worked from 1978 - 1980 in the post room. I would keep working in WM using the printing to do Deadbeat and the franking machine was my friend. Many on the mailing list received their Deabeat courtesy of the pawkle. I loved the lerning I got and when I was given a clip board and pen on leave to go to Uni I laughed. I returned regularly in holidays and was generally a lifer until the redundancy, spending a year finding the missing £600m, £1m-£3m a day etc which I've mentioned before.

My old work hired many kids from school and then as a trainee web developer/dealers or whatever. Most probably got the degree equivalent in under 3 years. I think the nefarious shite should be promoted not reserved for prime ministers. I always said if you meet someone at the bus stop and they smile when they say "gotta job", just say yes. Find them a job they'll love it and you will too.

There are numerous forces at work undermining the mental health of the young and calling them snow flakes is just nonsense. We now know a lot more about mental health than ever before. I studied Psychology and like many of my classmates I did it because I wanted to understand myself more, oh, and why the drugs worked. They didn't work for everyone and over my life I've come to an epiphany regarding myself. Recognise who and what you are. Own it, bottle it, it's you. If there are anti social elements from farting and belching to ranting alcoholic, try to minimise these and write a blog nobody will see. Its cathartic and also very helpful to let you deal with what are seismic changes that you are living through but cant change. Stress was always something I understood from a mathematical and physical perspective. Pressure can be an essential catalyst, but stress is when its gone too far and something is close to blowing. Just like getting a rocket up in the air, or a jobby out your bum, light pressure good, too much stress bad.

When I was 30 I was on my fifth house. Interest rates were quite high but house prices were relatively benign. I look at the 30 year old today and the majority of house owners that I know did not go to university.

When I was 30 the big three stress deliverers were transitions in relationship, house and job.

Nowadays they still alrgely go hand in hand as the global market demands we shift around to progress our careers and that means changing you house and in some cases relationship too. This is when the gender gap on student loans can frequently get magnified.

A couple who did their degree and post grad together, then get married have good careers then children then divorce will find the parent who took the time off for the child will have watched their debt magnify while the other's continued to shrink. If I was a lawyer I'd expect the debt to be shared equally. Hope it is.

House prices in the 80's and 90's marched ever upwards with the odd pause when seismic activity occured, like leaving the EMU and inflation, interest rates and house prices often followed global financial market collapses, eg the time it was famously not going to be too strong a wind in 1987. The winds of change were particularly hammered down during Labour's loss of the levers in the early 2000's. We'd moved through the dot.com bubble and the Y2k disaster to arrive in over-exhuberant times. I've quoted the Big Short many's a time but this is where we can also see the trace elements of our current gangster operations.

The poverty today is absolutely real and its not just financial. ITs a poverty of ideqas caused by a poverty of truth. The misleading and plain self confessed liars now wear their mis-truths, their lies like a badge of honour. It was all a game they played dirty and won. For some people someone like Trump or Farage are liars you would never believe but for others they thought they told the truth, even after they admitted that it was all just part of the game. Putting a slogan on the bus about the NHS was one of the simplest lies to tell. I'm suprised they didn't make it "£946mn a week for our NHS', nobody can add up and its all to grab a headline, while people would round it up to £1bn when they told their friends.....

My Dad is 91, I'm 60, we still have the same discussion about people n0t wanting to tell the truth and 'they'll be found out'. THat's not the game. The game is lie lie lie, and then roll the dice and move 8 spaces whatever you roll.

In the meantime the 30 year old is trying to work out when they will be able to buy a house. As interest rates rise it doesn't dampen their demand, they had no demand. Demand in the economy is not impacted by interest rates. Prices are rising because supply side issues.

The supply side issues that have shifted the price of olives and olive oil I can understand but rape seed oil I cannot.

Because cooking oil would go down as a bit of a necessity, unless you have the luxury of an air fryer, the only thing I see in the price hike is opportunistic profiteering. First rule of business is move upstream in time of turmoil. Reassuringly expensive is still a successful marketing move. I personally dont think it works with everything in the supermarket though.

I wrote before about the government abolishing VAT a lever that would have lowered inflation even if only applied to utilities. Small businesses that creatively hide under the threshhold emphasise why either the threshhold or the tax itself needs reforming. Taxes need to represent the society and the global market. In Scotland as we continue Thatcher decision to make us a service economy we have Education, Tourism, Financial, Games and Whisky. Within tourism we have History, hills and golf. I'm pretty sure the numbers for golf tourism will be getting healthier by the day as the clubs get wealthier by the year. Ireland and Scotland have cornered the $$$ and an average 7 days break to either can be considered in the $10,000-$20,000 bracket. They like to pay, so we encourage them to play. This makes the role that the golf clubs representatives, their own Trade and Sports union, Scottish Golf, a very important one. Cue the gangsters moving ? Is it the same for Education. I've written before about Edinburgh Uni becoming one of the biggest property company potentially in the city or is that the country. Universities have so much money I wonder why their staff need to strike or why they need to give them appalling pensions. THe income Edinburgh receives during the Festivals in August surpasses £60mn now. Those students who need to vacate their flats for the August bun fight compare with other universiteies where you pay for 12 months. Its an entirely huge topic why St Andrews and Edinburgh can earn as much from their summer lets as they do from the time of the year when students inhabit their dorms and tenements.

I digress, house prices, yes, no demand here. 30 year olds only aspiration is to avoid sharing a room, to have a living room in their flat, not have it as a third bedroom. They cant aspire to own the building but will half the £22,000 a year to rent it.

There is a demand, but its for lower house prices. Will the 'buy to let' people find themselves troubled by the level of their borrowing as interest rates rise. Ha ha I laugh, at long last I've found a small sample of people who will be hounded out of the market by higher interest rates. Unfortunately all the gangster money laundering johnnie foreigners can buy the houses with cash and convert them into more legal routes for that POCA avoiding cash.

So the true victims of this retail price hike, that comes with interest rate hikes is the people who have seen their savings vanish, their houses cooler and their cupboards left bare. Oh, and if they were 'stupid enough to go to university', a lovely hint of irony, then their debt is being put through a pressure cooker in a bid to ipe out what they've paid.

At £220bn, or as the Irish would laugh, the national debt, our English students and graduates will see the debt rise to £230bn before the financial year is out, on interest alone. Even if you pay £500-£1000 back, your debt will likely be rising by £3000-£5000.

At current rates only 27% are due to pay it back and the Government of the day picks up the tab. I would not want to win the next election unless the land and money grab of the past forty years is reversed and that would really upset the markets.

This is something the Bank of England cant take into its calculations. They have one blunt instrument.

The biggest growth industry in my minds eye is the adverts on tv for credit rating agencies. Now I know Kondratieff was right. We have reach the optimum end of this wave.

Greed in the marketplace will not be controlled by interest rates, indeed it may have the opposite effect as profiteering will be forced higher because the alternative is to close the shop or business and bank the money.

Ironically interest rates are more likely to hit the supply than the demand side.

Children who are now over 50 are still paying off student debt if they did masters or post grad stuff.

Children born in the 80's when university places were effectively removed for those whose parent did not own a home (bear with me here) or the broadening wealth classes who tried to encourage their children to aspire, dreams that few could ever achieve

Other points to explore

Encouraging emigration,

20 year or 30 year payback

Interest rates at 8% on the debt compared with 12% on your salary above a certain level means the debt has to increase if you earn less than £70,000-£80,000 depending on the size of the debt.

Then the government has to pick up the tab and the only ones to make money are the debt handlers.

Let me buy shares in them please!